1. Locate your title deeds.

If there is a mortgage on the property, the title deeds are with the lending institution. If there is no mortgage on the property, the deeds may be held in your solicitor’s office or at home. If you can’t locate your title deeds, don’t panic but inform your solicitor as soon as possible.

2. Review the planning history of the property.

If there was any development to the property, even if it did not require planning permission, this will have to be addressed in the Contract. Inform your solicitor about all the development and request clarification of whether or not you need to get any work certified by an architect. The purchaser is likely to send a surveyor out, who may raise this issue so it’s better to be ahead and also to be able to comply with your obligations under the Contract.

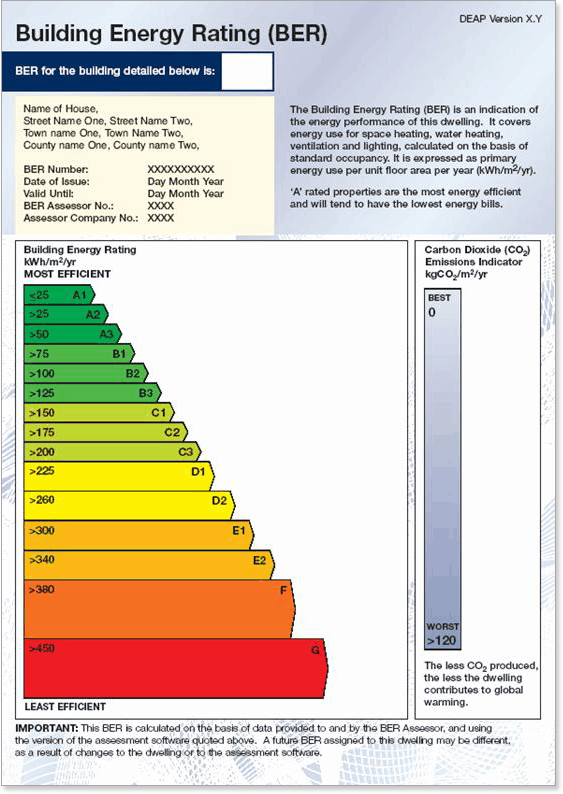

3. Get the BER certificate and advisory report done

Get this sent to your solicitor straight away. Often, the estate agent will have arranged it for you. If so, tell the agent to forward a copy to your solicitor as this often delays contracts issuing. Often, the BER certificate and advisory report are sent by email from the BER assessor to the seller or the estate agent. It is sufficient to send the documents by email with the contracts for sale, so don;t wait for a hard copy to be received from the BER assessor.

4. Apply for your Non- Principal Place of Residence Charge Certificate of Exemption or Discharge from your Local authority.

If the property was your principal place of residence for any year between 2009-2013 you need to apply for a certificate of exemption for the relevant year or years. If not, you need a certificate of discharge from your Local Authority. Your solicitor can make the application for you. If you did not reside in the property for any of the years 2009-2013 (on the liability date) then you need to talk to your solicitor about any liability charged on the property and also if there is any exemption that you could apply for.

5. Complete the Law Society Sale Questionnaire

Your solicitor will provide you with a questionnaire to complete. This will deal with all issues relating to the property and the vendors, which your solicitor will need to prepare the Contracts for Sale. This questionnaire is detailed but it has been prepared by the Law Society of Ireland to assist both the solicitor and the vendors, so it is advisable to get it completed as early as possible. We’ve put in our website here.

6. Check your Local Property Tax valuation band.

Check out our recent blog post all about the LPT changes and your obligations when you are selling a property.